Medium-term Management PlanInvestor Relations

Kurabo Group's New Medium-Term Management Plan "Accelerate'27"

The Kurabo Group formulated “Accelerate ’27,” a new three-year medium-term management plan (April 2025 – March 2028) which was the third stage of “Long-Term Vision 2030” that depicted the ideal state of the Group in 2030, and started it in April of this year. We are pleased to announce an outline of the plan as follows.

1. Basic Policy

“Accelerate growth in high-profit businesses and increase corporate value through efficient use of management resources”

We will accelerate the reform of our business portfolio to build a high-profit business foundation, which was promoted under the previous medium-term management plan Progress ’24, and will actively implement capital policies with an awareness of capital efficiency in order to enhance corporate value.

In achieving our goals, in addition to contributing to the realization of a sustainable circular economy, we will also focus on investment in our human resources, who form the foundation of our corporate management, with the aim of creating a highly engaged organization.

2. Numerical Targets

(¥100 million)

| FY2025 | FY2028 | |

|---|---|---|

| Net sales | 1,506 | 1,650 |

| Operating profit | 103 | 130 |

| Ordinary profit | 117 | 130 |

| Profit attributable to owners of parent |

90 | 110 |

| Key management indicators (FY2028) | |

|---|---|

| Operating profit ratio | 7.9% |

| ROE(return on equity) | 10.0% |

| ROA(return on assets) | 7.5% |

| ROIC(return on invested capital) | 7.9% |

3. Financial and Capital Policy

- (1) Shareholder return policy

-

(i) Set a target dividend on equity ratio (DOE) of 4% to ensure continuous and stable dividends, independent of business performance.

(ii) Repurchase treasury shares of 20 billion yen in three years of Accelerate ’27.

- (2)Policy of reducing cross-shareholdings

- Reduce cross-shareholdings to less than 20% of consolidated net assets by the end of FY2028, the final year of Accelerate ’27.

For further details, Please see below for details.

Accelerate ’27: New Medium-term Management Plan

1. Review of the Kurabo Group’s Long-term Vision 2030

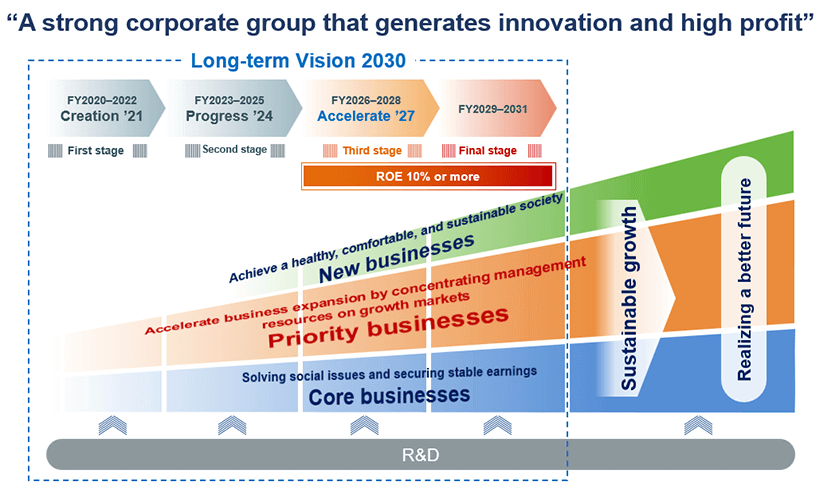

In March 2019, in an increasingly uncertain business environment, we formulated the Kurabo Group’s Long-term Vision 2030 with a goal of “a strong corporate group that generates innovation and high profit” to clarify the Group’s management direction toward long-term growth and sustainable enhancement of corporate value.

Under the management philosophy of “contributing to a better future through the creation of new value,” Long-term Vision 2030 is to create technologies, products, and services that will contribute to the realization of a sustainable society, and to transform the company into a high-profit business structure.

Six years have passed since its formulation, and the business environment surrounding the Group is becoming increasingly severe. However, by evolving our business strategy in response to changes in the environment, as well as by undertaking structural reforms, we have made progress in reforming our business portfolio to build a solid earnings base, and our Long-term Vision 2030 is progressing ahead of its planned targets.

2. Reflection on the Previous Medium-term Management Plan: Progress ’24

(1) Business performance trends

(¥100 million)

| <Entire company> | FY3/22 Result |

FY3/23 Result |

FY3/24 Result |

FY3/25 Result(1) |

FY3/25 Target(2) |

Comparison (1)―(2) |

|---|---|---|---|---|---|---|

| Net sales | 1,322 | 1,535 | 1,513 | 1,506 | 1,600 | △94 |

| Operating profit | 75 | 86 | 91 | 103 | 96 | +7 |

| Ordinary profit | 87 | 100 | 101 | 117 | 102 | +15 |

| Profit attributable to owners of parent |

56 | 55 | 67 | 90 | 72 | +18 |

| Operating profit ratio | 5.7% | 5.7% | 6.1% | 6.8% | 6.0% | +0.8 pt |

|---|---|---|---|---|---|---|

| ROE(return on equity) | 5.9% | 5.6% | 6.2% | 7.6% | 7.0% | +0.6 pt |

| ROA(return on assets) | 4.5% | 5.1% | 5.0% | 5.4% | 5.3% | +0.1 pt |

| ROIC(return on invested capital) | 4.6% | 5.3% | 5.2% | 5.5% | 5.6% | △0.1 pt |

Net sales under Progress ’24, the previous medium-term management plan which was the second stage of Long-term Vision 2030, were not achieved mainly due to the transfer of the machine tool business. But, as a result of business portfolio reforms aimed at building a highly profitable business foundation, including expansion of priority businesses in growth markets such as the semiconductor manufacturing-related market, we achieved the targets for profit at each stage.

In addition, ROE also improved, achieving its target of 7%, due in part to increased dividends and purchase of treasury shares in line with higher earnings.

(¥100 million)

| <By segment> | FY3/22 | FY3/23 | FY3/24 | FY3/25 (1) |

FY3/25 Target(2) |

Change (1)―(2) |

|

|---|---|---|---|---|---|---|---|

| Chemical Products Business |

Net sales | 516 | 597 | 613 | 660 | 630 | +30 |

| Operating profit | 29 | 37 | 39 | 50 | 39 | +11 | |

| Textile Business | Net sales | 446 | 565 | 511 | 485 | 540 | △55 |

| Operating profit | △1 | 3 | △2 | 0 | 8 | △8 | |

| Advanced Technology Business | Net sales | 235 | 242 | 255 | 219 | 290 | △71 |

| Operating profit | 27 | 28 | 35 | 33 | 30 | +3 | |

| Food and services Business | Net sales | 84 | 92 | 95 | 104 | 103 | +1 |

| Operating profit | 2 | 4 | 6 | 7 | 7 | +0 | |

| Real Estate Business | Net sales | 37 | 37 | 37 | 37 | 37 | +0 |

| Operating profit | 27 | 24 | 22 | 22 | 23 | △1 | |

(2) Summary of priority measures

3. Initiatives to Achieve Management with an Awareness of Capital Cost and Stock Price

- (1)Recognition of the current situation

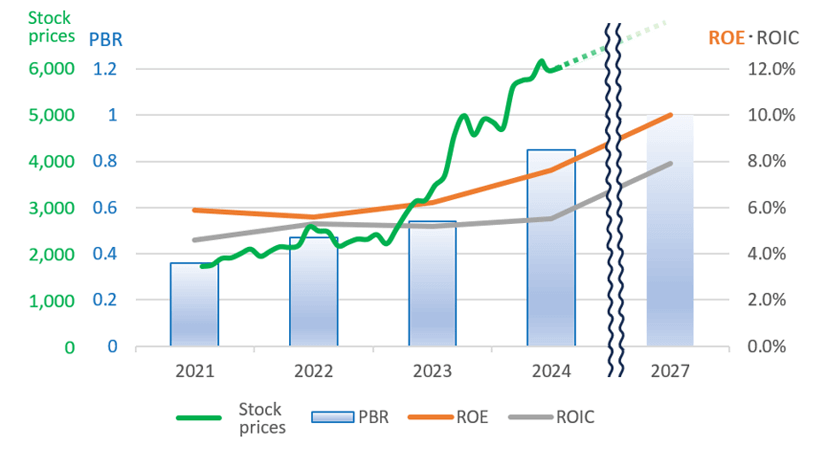

- ROE and ROIC are on an improving trend, as a result of working through Progress ’24 on both improving operating revenue and strengthening capital policy and IR activities. However, PBR is still below 1 at this point, and it is important to further strengthen initiatives going forward.

- (2)Future policy

- Although we understand that the cost of shareholders' capital is in the range from 6% to 7% based on methods such as CAPM, we recognize that shareholders expect a higher return. Therefore, to achieve the target of PBR of above 1.0 at first,we will work to achieve ROE of 10% that is our target of the new medium-term management plan explained in the next section, and also enhance our IR activities.

4. Accelerate ’27: New Medium-term Management Plan

Accelerate ’27 is the third stage of the Kurabo Group’s Long-term Vision 2030, which aims to create a strong corporate group that generates innovation and high profit. We significantly underachieved in the first stage, called Creation ’21, due to the considerable impact of COVID-19. However, we returned to the growth track of our long-term vision through the second stage, Progress ’24, with the expansion of semiconductor manufacturing-related businesses, which were our growth and priority businesses. In response, we have revised our long-term vision targets ahead of schedule, and this is an important stage for us to accelerate our business portfolio reforms to build a highly profitable business structure, which we undertook under Progress ’24, while efficiently utilizing our management resources to achieve these new targets.

- (1)Basic policy

- “Accelerate growth in high-profit businesses and increase corporate value through efficient use of management resources”

- (2)Priority measures

-

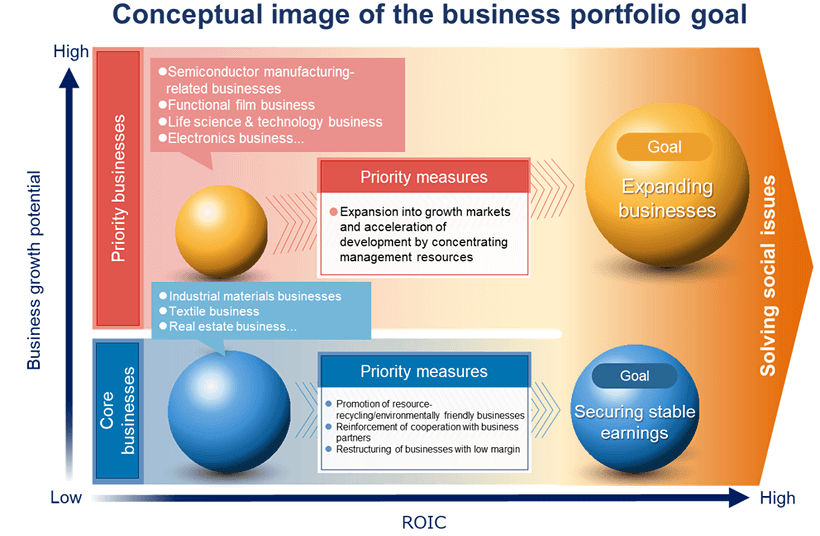

i. Develop and accelerate priority businesses in growth markets and strengthen profitability of core businesses

We will more quickly expand our business by concentrating our management resources in high-profit and priority businesses, namely, the high-performance products business, including high-performance plastic products business and functional film business, electronics business, and life science & technology business, for the growing markets of semiconductor manufacturing-related, automation and control equipment, and medical equipment.In addition, we will strengthen profitability to support the management foundation of the entire Group by securing stable earnings in core businesses and transforming the earnings structure of low-margin businesses, which contribute to solving social issues. ii. Strengthen R&D activities and create new businesses to place them on a profitable footing

ii. Strengthen R&D activities and create new businesses to place them on a profitable footing

The Technical Research Laboratory, the core of the Group’s R&D activities, will promote R&D activities focusing on robot sensing, semiconductor solutions, life science technology, and material solutions, while strengthening each core technology in collaboration with each Group division, in order to create new businesses and quickly place them on a profitable footing.

Moreover, we will also collaborate with public institutions and venture companies to create next-generation technologies that support sustainable growth as well as new technologies that contribute to a circular economy.iii. Contribute to the realization of a sustainable society

In accordance with the Corporate Governance Code established by the Tokyo Stock Exchange, the Group has formulated and disclosed its Basic Policy on Sustainability. In order to further promote sustainable management that aims to realize a sustainable society and increase corporate value under the Basic Policy and management philosophy, we have partially changed the governance structure related to sustainability and CSR, such as shifting from the “Kurabo CSR Committee” to the “Sustainability Committee” on April 1, 2025.

Under the new structure, we will not only govern ourselves in terms of compliance with human rights and laws and regulations, but also further strengthen our initiatives to address the materialities of the Group, which are also linked to our business activities, to promote activities that contribute to the realization of a sustainable society.

In addition, to promote sustainability and CSR throughout the supply chain, we will focus on appropriate management of the supply chain, including conducting questionnaire surveys with suppliers and requesting them to make improvements.iv. Build a highly engaged organization

Aiming to become “a strong corporate group that generates innovation and high profit” in an age of rapid change and to sustainably increase corporate value, we are focusing on developing employees who have the spirit of challenge and creative thinking ability to create new value with curiosity and actions, as expressed in the message to our employees on our 130th anniversary: “Bring the world something exciting” To this end, we believe it is essential to build a “highly engaged organization” in which each and every employee proactively contributes to the sustainable enhancement of corporate value in a work environment that is comfortable and rewarding, and we will work on measures to achieve this.

(3)Numerical targets

i. Consolidated performance targets and management indicators

(¥100 million)

| FY2025 | FY2026 | FY2027 | FY2028 | |

|---|---|---|---|---|

| Net sales | 1,506 | 1,440 | 1,520 | 1,650 |

| Operating profit | 103 | 80 | 112 | 130 |

| Ordinary profit | 117 | 95 | 120 | 130 |

| Profit attributable to owners of parent |

90 | 95 | 100 | 110 |

| FY2025 | FY2026 | FY2027 | FY2028 | |

|---|---|---|---|---|

| Operating profit ratio | 6.8% | 5.6% | 7.4% | 7.9% |

| ROE(return on equity) | 7.6% | 8.0% | 9.0% | 10.0% |

| ROA(return on asset) | 5.4% | 4.3% | 6.2% | 7.5% |

| ROIC(return on invested capital) | 5.5% | 4.4% | 6.4% | 7.9% |

ii. Performance targets by business segment

(¥100 million)

| FY2025 | FY2026 | FY2027 | FY2028 | Comparison | ||

|---|---|---|---|---|---|---|

| Chemical Products Business | Net sales | 660 | 640 | 680 | 740 | +79 |

| Operating profit | 50 | 39 | 55 | 60 | +9 | |

| Textile Business | Net sales | 485 | 435 | 450 | 490 | +4 |

| Operating profit | 0 | △7 | 6 | 12 | +11 | |

| Advanced Technology | Net sales | 219 | 222 | 240 | 270 | +50 |

| Operating profit | 33 | 30 | 34 | 40 | +6 | |

| Food and services | Net sales | 104 | 105 | 112 | 112 | +7 |

| Operating profit | 7 | 7 | 7 | 8 | +0 | |

| Real Estate Business | Net sales | 37 | 38 | 38 | 38 | +0 |

| Operating profit | 22 | 22 | 22 | 22 | △0 | |

| Elimination or entire company* | Operating profit | △11 | △11 | △12 | △12 | △0 |

| Total | Net sales | 1,506 | 1,440 | 1,520 | 1,650 | +143 |

| Operating profit | 103 | 80 | 112 | 130 | +26 | |

* "Elimination or entire company" mainly consists of research and development expenses that do not belong to any segment.

(4)Business policy and priority measures of each business segment

- (Chemical Products Business)

- ・Concentrate management resources on the high-performance products business for semiconductor and energy-related markets and accelerate business expansion.

- ・Develop new businesses in the field of industrial materials for the automotive and housing-related markets and cultivate markets in depth.

- (Textile Business)

- ・Promote development of proprietary technologies based on end-user needs and expand sales of proprietary technology products.

- ・Establish a global supply chain centered on overseas manufacturing bases.

- (Advanced Technology Business)

- ・Accelerate growth of life science & technology business and semiconductor-related business.

- ・Develop markets for environment- and infrastructure-related businesses that contribute to solving social issues, and strengthen profitability.

- (Food and Services Business)

- ・Expand market penetration of existing products and services, promote development of differentiated products and services, and cultivate sales channels.

- (Real Estate Business)

- ・Manage currently owned real estate in a systematic and efficient manner and quickly place idle real estate on a profitable footing.

(5)Basic investment policy

In order to sustainably increase corporate value, we will actively, continuously, and appropriately invest in M&As, capital expenditures, R&D, intellectual property, and human resources for growth.

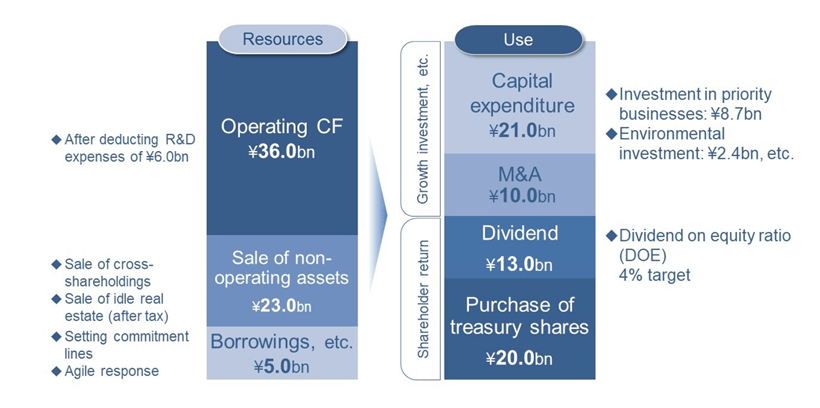

With regard to capital expenditures, we will focus on priority businesses and environmentally conscious investments in order to achieve sustainable growth. Similarly, for M&A investments that will contribute to the expansion of the Group’s business, we assume to invest 10 billion yen by narrowing down our targets to the semiconductor manufacturing-related and life science & technology fields. We will respond proactively and flexibly to take advantage of opportunities.

(¥100 million)

| Capital expenditures(three-year total) | ||

|---|---|---|

| Priority businesses | 87 | |

| Environmental investment | 24 | |

| IT investment | 10 | |

| Maintenance, renewal, etc. | 89 | |

| Total | 210 | |

| M&A investment | 100 | |

| Depreciation | 178 | |

(¥100 million)

| Research and development expenses (three-year total) | ||

|---|---|---|

| FA and robots | 8 | |

| Semiconductor manufacturing-related | 13 | |

| Gene extraction and analysis | 5 | |

| Functional materials | 20 | |

| Other | 14 | |

| Total | 60 | |

(6)Financial and capital policy

- i. Shareholder return policy

-

Recognizing that paying dividends to shareholders is one of the most important issues for the company, we have set a target dividend on equity ratio (DOE) of 4% for the Accelerate ’27 period as our basic policy for continuous and stable profit distribution.

Moreover, in order to enhance shareholder returns and improve capital efficiency, we will also purchase treasury shares of 20 billion yen over the three years of Accelerate ’27. - ii. Policy of reducing cross-shareholdings

- we will sell cross-stockholdings in stages and reduce them to less than 20% of consolidated net assets by the end of FY2028, the final year of Accelerate ’27.

- iii. Cash allocation

- In Accelerate ’27, the source of funds (cash inflows) is expected to be the operating cash flow generated over the three-year period and proceeds from the sale of non-operating assets, i.e., cross-shareholdings.

Allocations of these cash inflows will be used for capital expenditures and M&A for growth in accordance with the basic investment policy and for dividends and purchase of treasury shares in accordance with the capital policy.

(Caution) The business performance and other information contained in this document are based on the Group’s forecasts based on the business environment and other factors at the time the document was prepared, and are not guarantees or assurances that the future business performance figures and measures described will be realized.